Cryptocurrency Investment: Navigating the Digital Asset Frontier in 2025

In 2025,Cryptocurrency investment is transforming the way people build wealth, offering both exciting opportunities and unique risks. Whether you’re new to digital assets or seeking smarter strategies, understanding the basics is key to making confident and informed decisions in this fast-moving market.

Cryptocurrency has transcended its initial niche status to become a significant, albeit volatile, asset class that attracts a broad spectrum of investors,Cryptocurrency Begineer's guide, From individual retail participants to major financial institutions, the allure of digital assets as a potential avenue for wealth creation and portfolio diversification is undeniable. However, the unique characteristics of this market demand a thorough understanding of both its immense opportunities and inherent risks.

This comprehensive article will explore the multifaceted nature of cryptocurrency investment, delving into its potential benefits, the crucial risks to consider, and practical strategies for US investors looking to navigate this dynamic digital frontier.

Understanding Cryptocurrency Investment Vehicle

At its core, investing in cryptocurrency means acquiring digital assets with the expectation that their value will increase over time, yielding a profit upon sale. Unlike traditional stocks or bonds which derive value from company earnings or interest payments, cryptocurrency's value is often driven by:

Network adoption and utility: How widely is the blockchain technology used for transactions, smart contracts, or decentralized applications (dApps)?

Scarcity and supply dynamics: Many cryptocurrencies, like Bitcoin, have a limited supply, which can create deflationary pressure.

Technological innovation: The development of new features, improved scalability, or enhanced security can drive demand.

Market sentiment and speculation: News, social media trends, and investor psychology play a significant role in price movements.

Regulatory clarity: Favorable regulatory environments can boost investor confidence and institutional adoption.

The Allure: Why Consider Cryptocurrency for Your Portfolio in 2025?

Several compelling reasons make cryptocurrency investment in the current financial climate:

High Growth Potential: The cryptocurrency market, while volatile, has demonstrated extraordinary growth potential over the past decade. Even in mid-2025, with Bitcoin consolidating above $100,000, analysts foresee further appreciation driven by increased mainstream adoption and utility. Early investors in groundbreaking projects have seen exponential returns.

Portfolio Diversification in Cryptocurrency

: Cryptocurrencies can offer diversification benefits to a traditional investment portfolio. Their price movements often exhibit a low correlation with traditional assets like stocks and bonds, meaning they may behave differently during market downturns. Including a small allocation to crypto could potentially enhance overall portfolio returns while managing risk.

Hedge Against Inflation: Bitcoin, in particular, is often touted as "digital gold" – a decentralized, finite asset that can act as a hedge against fiat currency debasement and inflation. As global economies grapple with inflationary pressures, many investors are turning to assets with a predetermined, immutable supply.

Technological Innovation and Future Growth: Investing in cryptocurrency is also an investment in the underlying blockchain technology and the burgeoning Web3 ecosystem. This includes:

Decentralized Finance (DeFi)

: A financial system built on blockchain, offering services like lending, borrowing, and trading without intermediaries. The DeFi market is projected to reach over $32 billion in 2025 and grow exponentially.

Non-Fungible Tokens (NFTs): Unique digital assets representing ownership of art, collectibles, music, and more. The NFT market is also forecast to expand significantly, driven by digital identity and ownership trends.

Web3 and Decentralized Applications: The next generation of the internet, promising greater user control, privacy, and new business models, is powered by blockchain and crypto. Investing in the foundational tokens of these platforms offers exposure to this technological shift.

Increasing Accessibility and Legitimacy (Especially in the US):

The approval of Spot Bitcoin ETFs in the US has dramatically simplified access for traditional investors, allowing them to invest in Bitcoin through their existing brokerage accounts.

The strong likelihood of Spot Ethereum ETFs and potential for other crypto ETFs suggests a broadening of regulated cryptocurrency investment products.

Major financial institutions like BlackRock and Fidelity actively participating in the crypto space lend significant legitimacy to the asset class, making it more palatable for a wider audience.

The Risks: A Prudent Investor's Checklist

Despite the attractive upsides, investing in cryptocurrency carries substantial risks that no investor should overlook:

Extreme Volatility: Cryptocurrency prices are notoriously volatile, subject to rapid and unpredictable price swings. A coin's value can plummet by 50% or more in a matter of days or even hours. This high volatility means the potential for significant losses is just as real as the potential for gains. Never invest more than you are prepared to lose entirely.

Regulatory Uncertainty: While some clarity has emerged, the US regulatory landscape for cryptocurrencies is still evolving. The SEC, CFTC, and other government bodies continue to grapple with how to classify and oversee various digital assets. Sudden regulatory actions, new laws, or even unfavorable court rulings can drastically impact market sentiment and asset values. For example, the IRS's evolving guidance on crypto taxation can add complexity.

Security Risks and Scams: While blockchain technology is secure, individual investors face risks from:

Hacks and Exploits: Exchanges, DeFi protocols, and personal wallets can be targets for sophisticated hackers.

Phishing Scams: Malicious actors attempt to trick investors into revealing private keys or login credentials.

Rug Pulls and Ponzi Schemes: Fraudulent projects designed to deceive investors and disappear with their funds are rampant in the less regulated corners of the market.

Loss of Private Keys: If you lose your private keys or seed phrase to a self-custody wallet, your funds are permanently inaccessible.

Market Manipulation: The relatively nascent and less regulated nature of some crypto markets makes them susceptible to manipulation by large holders ("whales") or coordinated groups.

Technological Complexity: Understanding the nuances of different blockchains, consensus mechanisms (Proof-of-Work vs. Proof-of-Stake), smart contracts, and wallet management can be daunting for beginners.

Liquidity Concerns: While major cryptocurrencies like Bitcoin and Ethereum are highly liquid, many smaller altcoins can have low trading volumes, making it difficult to buy or sell without significantly impacting their price.

Getting Started: A Step-by-Step Investment Approach for US Investors

For those ready to explore cryptocurrency investment, a disciplined and informed approach is essential:

Educate Yourself Extensively: Before investing any capital, commit to understanding the basics. Learn about blockchain, Bitcoin, Ethereum, different altcoins, decentralized finance, and the various risks involved. Utilize reputable resources, not just social media hype.

Define Your Cryptocurrency Investment Goals and Risk Tolerance: Are you looking for long-term growth, or do you have a shorter-term horizon? How much risk are you genuinely comfortable taking? This crucial step will guide your portfolio allocation. Many financial advisors suggest crypto should be a small percentage (e.g., 1-5%) of a diversified portfolio due to its high risk.

Choose a Reputable US-Regulated Exchange or Brokerage: Select a platform that adheres to US regulations and has a strong security track record. Look for:

SEC/CFTC Compliance: Ensures the platform operates legally within the US.

Robust Security: Two-factor authentication (2FA), insurance on digital assets (if offered), and cold storage practices.

User-Friendly Interface: Especially important for beginners.

Competitive Fees: Understand the trading and withdrawal fees.

Common Choices: Coinbase, Kraken, Gemini, and traditional brokerages offering Bitcoin ETFs are popular options for US investors.

Understand US Tax Implications: As of 2025, the IRS classifies cryptocurrency as property. This means:

Capital Gains/Losses: Selling crypto for USD, trading one crypto for another, or using crypto to purchase goods/services are all taxable events. Short-term gains (held <1 year) are taxed at ordinary income rates; long-term gains (held >1 year) are taxed at lower rates.

Ordinary Income: Receiving crypto from mining, staking rewards, airdrops, or as payment for services is taxed as ordinary income.

Form 1099-DA: Starting January 1, 2025, US crypto brokers are mandated to report user digital asset sales to the IRS using Form 1099-DA.

FIFO (First-In, First-Out) Mandate: From January 1, 2026, FIFO will generally be the mandatory cost basis method for calculating gains/losses.

Consult a tax professional specializing in crypto for accurate guidance on your individual situation.

Start Small and Diversify: Begin with a modest amount you are comfortable losing. Instead of putting everything into one coin, consider diversifying across a few major, established cryptocurrencies (like Bitcoin and Ethereum) and perhaps a small allocation to promising altcoins with strong fundamentals.

Secure Your Cryptocurrency Investments:

Enable 2FA: On all your exchange accounts and digital wallets.

Strong, Unique Passwords: Use complex passwords not reused elsewhere.

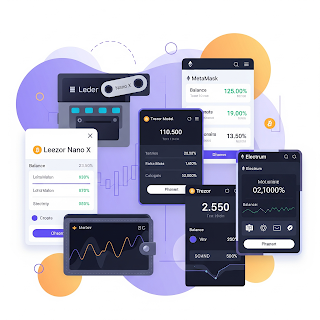

Consider a Hardware Wallet (Cold Storage): For larger holdings, hardware wallets (e.g., Ledger, Trezor) offer superior security by keeping your private keys offline and out of reach of online threats.

Beware of Scams: Be highly skeptical of unsolicited offers, promises of guaranteed returns, or requests for your private keys.

Adopt a Long-Term Perspective and Dollar-Cost Average (DCA): Cryptocurrency markets are highly susceptible to short-term emotional trading. Many successful investors employ a long-term "HODL" (Hold On for Dear Life) strategy and use DCA, where they invest a fixed amount regularly (e.g., weekly or monthly) regardless of the price. This mitigates volatility risk and avoids trying to "time the market."

Stay Informed and Adapt: The crypto space is constantly evolving. Keep up with market news, technological advancements (e.g., new Layer-2 solutions, breakthroughs in Web3), and regulatory developments.

Beyond the Basics: Exploring Broader Crypto Investment Avenues

As you gain experience, you might explore more advanced Cryptocurrency investment opportunities within the crypto ecosystem:

Staking: Earning rewards by "locking up" your cryptocurrency to support the operations of a Proof-of-Stake blockchain network.

Yield Farming: Providing liquidity to DeFi protocols in exchange for fees and rewards.

Liquidity Providing: Contributing assets to decentralized exchanges (DEXs) to earn a share of trading fees.

Investing in Emerging Sectors: Exploring niche areas like GameFi (blockchain gaming), DePIN (Decentralized Physical Infrastructure Networks), or Real-World Asset (RWA) tokenization, which are gaining traction.

Conclusion: A Calculated Journey into Digital Assets

Cryptocurrency investment presents a unique blend of high potential and significant risk. For US investors in 2025, the landscape is becoming more accessible through regulated products like Bitcoin ETFs, and the underlying technology continues to mature. However, the onus remains on the individual investor to exercise extreme caution, conduct thorough research, and adhere to sound financial principles.

By embracing continuous learning, understanding the regulatory and tax implications, implementing robust security measures, and approaching the market with a long-term, diversified strategy, you can confidently embark on your journey into the transformative world of digital assets. Remember, the future of finance is constantly being rewritten, and being an informed participant is your best investment.

Post a Comment

Please do not comment any spam links